Why "aisle bullshit" has more than one brand

This time, it's a study from SFU arguing that TMX isn't economically viable. Here's why it's just as wrong as all the other ones.

Last week, I was criticizing the latest climate change report from the Fraser Institute on the basis that it was built on the flimsiest of intellectual foundations — namely, its inability to understand how Canada’s output based pricing system actually works. But as I was reminded this week, there’s another intellectual product from British Columbia that gets regularly re-stocked in aisle bullshit: studies about why the Trans Mountain expansion isn’t economically viable.

Former ICBC CEO Robyn Allan has been churning these out for years now, and she dutifully championed the latest iteration on Twitter. But this time, it’s from Simon Fraser University’s School of Resource and Environmental Management, where Thomas Gunton — once a senior bureaucrat in the Glen Clark government — and a team of researchers have recycled the familiar case against TMX. "The $11.9 billion loss to Canada is primarily due to a more than doubling of the Trans Mountain construction costs from the original $5.4 billion to $12.6 billion, combined with new climate policies just confirmed by the Supreme Court that will reduce the demand for oil,” Gunton is quoted as saying in a press release.

First of all, let’s deal with the facts here. No, the decision by the Supreme Court of Canada to uphold the constitutionality of the federal carbon tax won’t have a meaningful impact on global demand, much less the demand in Asia, where the barrels flowing through TMX would almost certainly end up. Opponents of TMX like to point out that the barrels flowing through the current Trans Mountain line haven’t ended up there yet, but that’s because they’re floating south to California, where shipping costs are much lower. As the capacity of TMX expands, so too will its range of cargo destinations.

But this is a minor quibble compared to the more egregious errors the study makes in the course of its analysis. As former bank economist and commodity expert Rory Johnston pointed out on Twitter, the paper is marbled with bad or demonstrably false assumptions about oil markets — a thing he knows plenty about. First among them is that optionality matters, both for oil producers and railway operators. Being able to ship a barrel to Asia has more value than being able to move it south to the United States, especially when demand in the former is still rising and demand in the latter has almost certainly peaked. Railways, meanwhile, can move any number of things, from commodities like grain and potash to consumer and industrial products — and more space for those means lower costs for the companies shipping them.

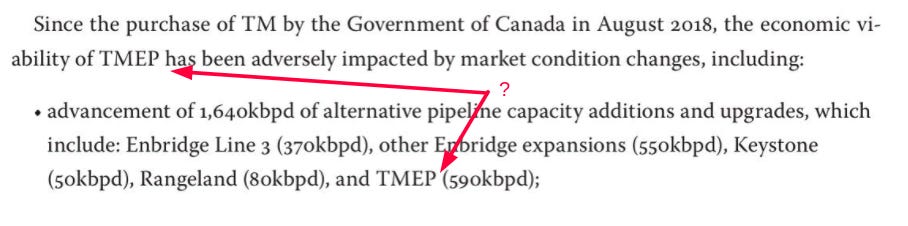

Perhaps the biggest issue in the paper is its treatment of both demand for crude oil and the supply of pipeline capacity in Canada needed to move it. I’ve been suggesting for some time that Keystone XL’s loss isn’t actually much of one, given that it would have added more capacity than Canada may ever need. And the paper’s authors are correct when they write that a range of under-the-radar pipeline expansions have added to that capacity. But they also appear to believe that this includes the Trans Mountain Expansion itself:

That’s hardly the only sloppy error in the paper. Indeed, the sloppiest might be the way it treats the impact of the pipeline on the upstream margins of companies using it to ship their oil. After all, in their cost-benefit analysis of the project, they assign this a value of…..zero.

This suggests that the substitution of crude-by-rail by pipeline, which will save shippers upwards of $5 per barrel, would have no impact on their “netbacks” — which is oil and gas industry shorthand for operating profit. This is a bit like the Fraser Institute pretending that the OBPS, which is explicitly designed to shield certain industries from the full effect of carbon pricing (because they could simply relocate to other jurisdictions, which would produce a lose-lose outcome for the economy and the climate), doesn’t have a meaningful impact on the economic costs of a carbon tax. Both seem to be about reverse-engineering their assumptions to suit their pre-existing conclusion, and neither is worthy of anyone’s time.

Is there a situation in which TMX could cost taxpayers this much money? Yes, in theory. But you have to really bend and twist yourself in order to get there, and it requires you to ignore, or at least heavily discount, a bunch of very important realities, just as the Fraser Institute study had to twist and bend to arrive at its own conclusion. And just as the Fraser Institute authors didn’t update their priors when it came to the treatment of the OBPS (something that other economists pointed out to them after they released a 2019 paper), neither did the SFU authors on the economics of Canadian oil.

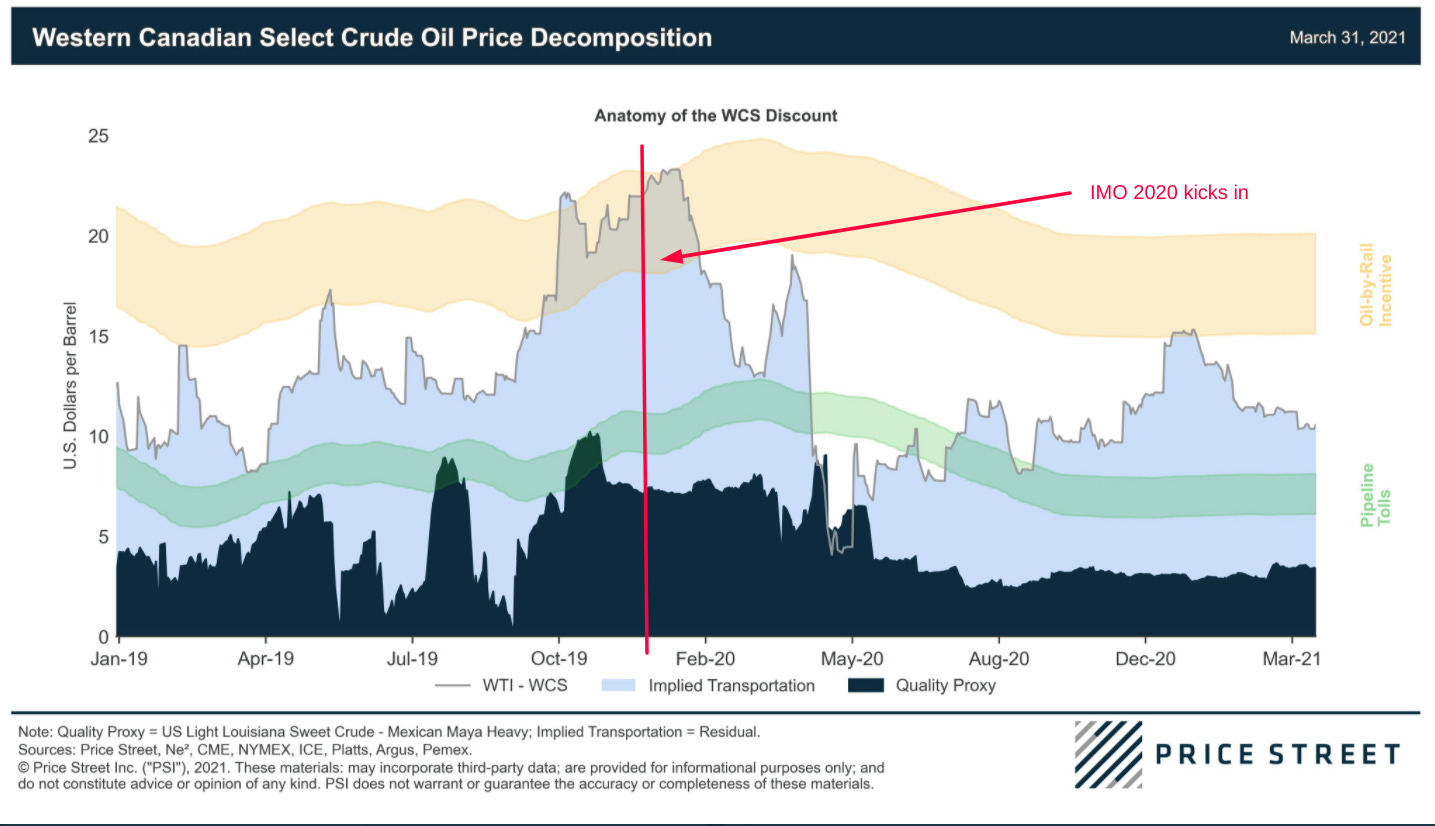

Case in point: they cite a 2018 paper that argues the IMO 2020 regulations (which mandated a reduction in the sulphur content in the oil that large ships use from 3.5% to 0.5%) could drive the so-called “differential” between Canadian heavy oil and WTI up from $13 per barrel to $33 per barrel. But those regulations came into force on January 1, 2020, and their impact on the prices received by Canadian heavy oil producers has been virtually non-existent.

So, what’s really going on here? It seems to me that, just like the folks at the Fraser Institute, Gunton and his colleagues are more interested in reaffirming their previous arguments and beliefs than testing them against the realities that are actually out there right now.

I’d strongly suggest that everyone avoid shopping from aisle bullshit. Even if the product in question is something that appeals you to, it pays to check the ingredients — and ensure that they’re not selling you on something that’s well past its best-before date.

Go big or go home

For a guy who was billed as a moderate, Joe Biden certainly isn’t behaving much like one so far. On the heels of a stimulus package that was aggressively ambitious, his administration has announced its intention to finally do that infrastructure week that Donald Trump spent four years talking about. And unlike Trump’s infrastructure ideas, the ones coming out of the Biden White House full embrace and understand the challenge of climate change.

As Jenkins details in a subsequent tweet, that money will include:

$174 billion for electric vehicles

$165 billion for public transit & rail

$100 billion for upgrading the electricity grid

$46 billion for clean energy manufacturing

$35 billion for clean energy research and development

And, to top off all of this direct spending, the plan will also include $400 billion in clean-energy credits.

This is obviously good news for the United States, but it’s also an opportunity for Canada as well — if we can take advantage of it. According to a new research note from RBC, “a new continental trade strategy could help reestablish Canada’s export sector as a key driver of economic growth, pushing toward an ambitious but reasonable target of $1 trillion* in additional exports by 2030.”

After years of watching our relative share of US imports drop, this shift by the Biden administration could allow Canada to start growing its piece of the American pie. But it will require decisive action and an unapologetic embrace of the energy transition — something that won’t be easy if the Liberals don’t win a majority in the next election.

One cool thing: Shell puts its (executives’) money where its mouth is

On climate, Shell has long been one of the more progressive supermajors out there. Now, if shareholders approve their new plan at their May AGM, they’ll be the ensuring that their senior executives are paid at least in part on that basis. According to a story in Reuters, the company’s senior executives will have 20% of their so-called “long-term incentive plan” tied to the company’s ability to achieve its net-zero target. It’s also severing the tie between those bonuses and its LNG volumes.